GST reforms: Industry highlights impact of insurance and medical device tax changes

By Express Healthcare

Reviewed by : Ujala Cygnus

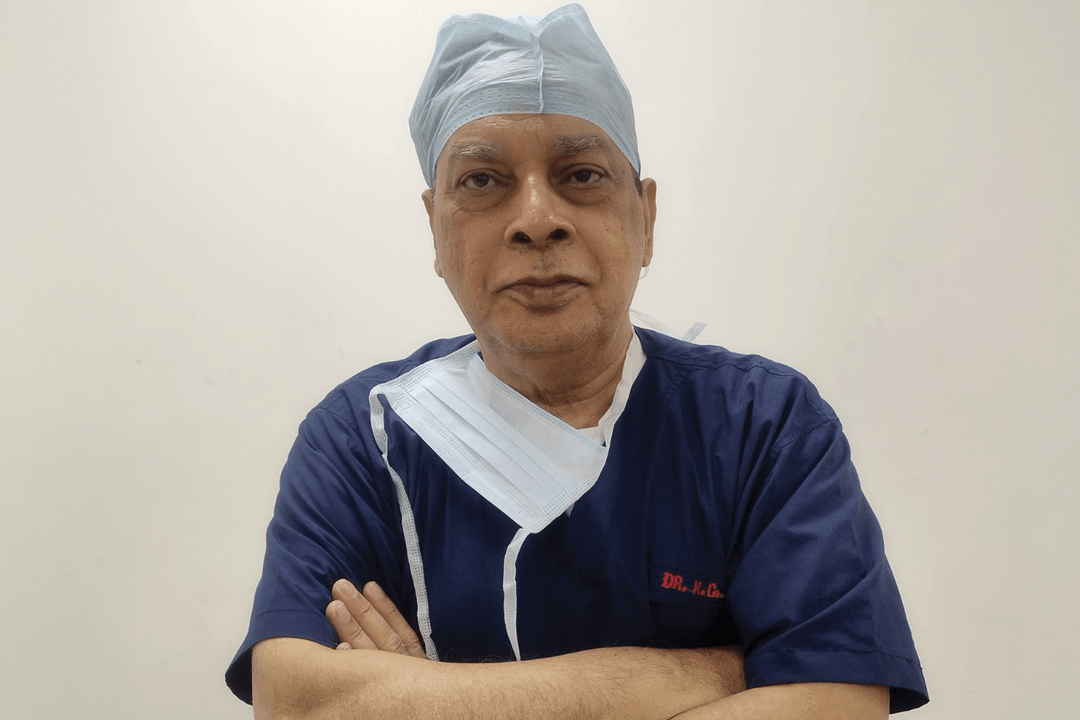

Dr Shuchin Bajaj, Founder-Director, Ujala Cygnus Healthcare Services

We welcome the government’s decision to reduce the GST on critical medicines and medical devices to 5% and exempt life and health insurance from GST altogether. These rate reductions will immediately lower the cost of angioplasty stents, cancer drugs, dialysis consumables, and essential diagnostics in our 25+ hospitals, making quality care more affordable to millions of middle- and low-income families.

By lowering the price of insurance premiums, the nil GST on health and life cover will encourage more people to protect themselves and their loved ones, reducing the need for catastrophic out-of-pocket spending. Together, these measures will expand early diagnosis, strengthen preventive care, and accelerate India’s journey toward universal health access goals that Ujala Cygnus remains committed to every single day. We would also continue to urge the government to allow hospitals and healthcare establishments to take benefit of GST input credit, as this will lower the cost of healthcare to patients even further.

Loading...